Aspen Financial Portfolio Management

Portfolio management is the process of picking the type and mix of investments, to achieve a specific investment goal, then monitoring and adjusting those investments over time.

We help you meet your longer-term goals with an investment strategy that’s specifically designed for you. And we’re transparent about the investment decisions we make for you because we believe an informed investor is a better investor and a happier client.

Much like a tailor who alters the hem, sleeves, and collar of a suit to fit an individual's proportions, we take a variety of factors into account to create a portfolio tailored to your needs.

At Aspen, We Go Beyond just recommending an asset or investment strategy. We stay in touch with our clients as their needs evolve and market conditions deviate. We are invariably transparent about the investment decisions we recommend to investors because we believe an informed and well-educated investor is a better and happier client.

Approach

Flexible

Every investor has unique needs. Some want growth or cash flow, others want to avoid certain industries or companies.

At Aspen, investment management starts with you. We take the time to understand your long-term goals and specific needs. Only then can we create a tailored portfolio recommendation that focuses on your goals and adapts as the market changes.

Comprehensive

Many American investors have an incomplete view of investing—focusing chiefly on US stocks and Assets. However, the US makes up only about half of the value of the world stock market. That’s important because some of the largest, fastest-growing, best-run companies are outside the US. With a comprehensive, global focus, you can increase diversification and take advantage of opportunities many investment managers miss.

Discipline

You deserve a manager who does more than just pick stocks. Aspen Financial Management meticulously analyzes markets, identifies the most attractive investment categories, and then chooses individual stocks, bonds, or other securities for your portfolio. Our thorough approach yields result over time.

Dynamic

Many investment advisers stick to one style of investing, such as growth, momentum, or value. But what happens when their style falls out of favor? That’s when narrow specialization could hurt your portfolio returns and that could be described as PERIL. We at Aspen, prefer a flexible approach that can adapt to our forward-looking market views.

OUR FUNDAMENTAL PRINCIPLES & PHILOSOPHY TO MITIGATE RISK

FUNDAMENTAL PRINCIPLES

How do we tactically build and manage portfolios to execute a long-term investment strategy?

Investing in markets can be a long road, but our goal is to steer your portfolio in the right direction to help meet your long-term objectives. There will be times when staying with an appropriate, long-term investment strategy can be difficult—for example, when increased near-term volatility may be difficult to handle emotionally or when investors may be tempted to chase heat.

Our four basic rules of portfolio management can provide you with an investment compass. Remembering these four rules can help keep your long-term investment strategy aligned with your investment goals and objectives.

- 1. Select a benchmark.

First, select an appropriate benchmark. An appropriate benchmark is necessary to measure relative risk and return and should be consistent with your time horizon and your required rate of return. A benchmark provides a framework for your investment strategy to help construct a portfolio, manage risk, and monitor performance. A properly benchmarked portfolio provides a realistic guide for dealing with various market conditions. A strategic portfolio should be structured to maximize the likelihood of achieving goals. Simply aiming to achieve a fixed rate of return each month or year can cause disappointment when capital markets are very strong and greatly outperform your objective and is potentially unrealistic when capital markets are very weak. - 2. Analyze the benchmark’s components and assign expected risk and return.

Once an appropriate benchmark is selected, each of the benchmark’s components is assigned expected risk and return. The objective here is to add value relative to the benchmark (although not necessarily in every period) while managing risk relative to the benchmark. Based on our outlook for capital markets, we determine risk and return expectations on benchmark components, which help us determine where the potential opportunities and pitfalls are. Anticipation of market conditions in specific sectors and countries allows us to weigh them accordingly in portfolio construction. -

3. Blend dissimilar securities & diversify your portfolio;

The next step is to blend dissimilar securities to balance risk relative to expected return. The basic principle is to overweight benchmark components (countries, sectors, size, style) we believe are likely to outperform the benchmark and underweight components we believe are likely to underperform. We believe making these calculated decisions increases the likelihood we can add value relative to a benchmark over time. Additionally, building a counter investment strategy into the portfolio is essential in cases where the core investment strategy delivers less than anticipated. To moderate that risk, we blend securities with low correlations and hold them in underweight positions relative to the benchmark. For example, if technology stocks are expected to outperform, we may also hold some stocks that tend to zig (like pharmaceuticals) when technology stocks zag to offset relative risk if tech underperforms. -

4. Always remember we could be wrong, so we don’t veer from the first three rules.

Overconfidence is a dangerous trait in portfolio management and in choosing alternative investment strategies. It can sway investors to divert from sound investment objectives and assume sub-optimal levels of risk such as options trading or other alternative investment strategies. That’s why we always remember we could be wrong, so we maintain our investment discipline and don’t forget the first three investment strategy rules.

OUR PHILOSOPHY

Our investment philosophy is rooted in the firm’s belief that capitalism is the best possible economic structure in this imperfect world. Individuals acting in their own interest in search of profits are forces that ultimately better all. Markets are a manifestation of this and a means to participate and financially benefit.

- Supply and Demand Determine All Prices Including Stocks and Bonds.

Like anything traded in a market economy, cryptocurrency, stock, and most assets prices are driven by supply and demand. Demand factors reign in the near term. They can wiggle for any reason—sentiment, political factors, or fundamentals. Longer-term, though, supply factors dominate. Rising supply, in the form of initial public offerings (IPOs), secondary offerings, and stock-for-stock mergers often produce headwinds for markets. But supply can shrink as well! Share buybacks and cash mergers reduce it—typically a bullish factor in our view. -

Market Cycles Can Be Forecast, Their Short-Term Wiggles Cannot

While we don’t believe consistently timing daily, weekly, or monthly market moves is possible, we do believe cyclical changes are foreseeable. Often, such changes are driven by events the vast majority of investors either overlook or interpret incorrectly: disconnects between fundamental reality and the investing public’s perception of reality. Successful forecasting requires assessing both. Stocks are forward-looking, yet most investors’ feelings are heavily influenced by the recent past. Bull markets tend to begin during recessions—when people feel most bleak—and end during euphoric “booms.” -

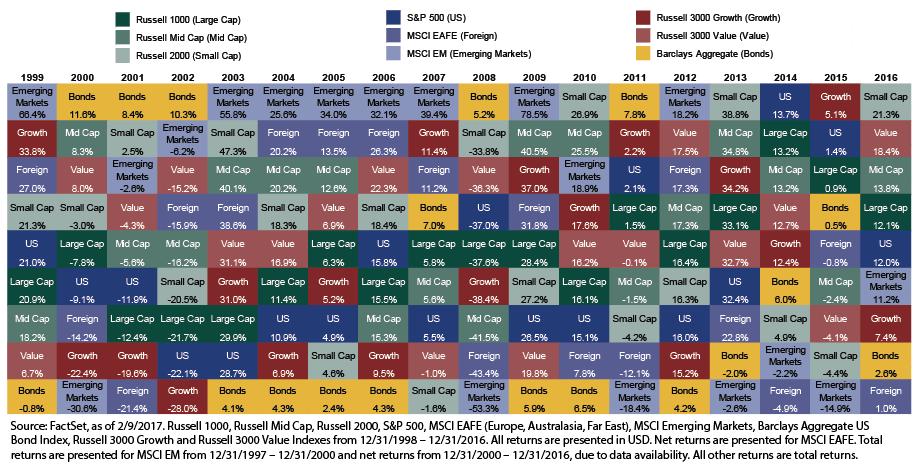

No Investment Is Permanently Superior

Different categories of securities outperform at different times. For example, smaller stocks sometimes outperform larger (and vice versa), foreign and domestic trade-off leadership, and dividend-paying stocks sometimes outperform non-dividend paying. No style or class of security is permanently superior, leadership rotates irregularly. Outperformance trends typically last over a foreseeable timeframe, providing opportunities for investors to capitalize. Our view stands in contrast with other firms who argue the inherent superiority of a certain size, style, or type of security. If that were true, wouldn’t all investors simply flock to the superior stocks, driving prices higher than fundamentals warrant? -

Global Diversification Is Preferable

Finance theory holds that correctly constructed stock indexes will have very similar returns over long timeframes. But the journey to this destination differs: The narrower the index, the rockier the trip, while a broader approach helps smooth the journey. A global approach is more diversified than a country-specific one. Moreover, a global approach accounts for performance rotation. No nation’s or region’s companies are inherently superior. Leadership rotates—frequently. We believe a global approach increases your opportunities to outperform and can mitigate country-specific risk factors, like political or legislative risks. -

To Beat Equity Indexes, You Must Look Beyond the News

Have you seen how fast stocks move when earnings reports are released? Or when mergers are announced? It’s near-instantaneous. Markets are incredibly efficient at pricing in widely-known information. Getting an edge over the market requires seeing the world differently and more correctly than the crowd. If major financial media is reporting it, it’s already reflected in market prices by the time it reaches you and everyone else.

Many investment managers and funds specialize in particular areas of the market. They might invest in only US stocks, high-yield bonds, or even more specific areas of the market, like small-cap growth stocks. A snapshot of their performance at any given moment might seem impressive. But what happens when their narrowly focused investment strategy falls out of favor?

-

Investment strategies can be broken into many different categories, such as:

- Asset class: stocks, cryptocurrency, bonds, cash, and other securities

- Style: growth vs. value

- Size: large, mid, and small-capitalization companies

- Geographic region: the US, foreign developed markets, and emerging markets

“More importantly, there is no predictive pattern in past performance to tell which styles will be the next leaders and laggards”

Research-Driven Agility

In our experience, no single strategy is always superior, and those who adopt such an approach can underperform as leadership styles continually rotate. At Aspen Financial Management, we use an active investment approach, led by our Investment Policy Committee and in-house Research department, that helps us respond to market shifts and their impact on clients’ portfolios.

Aspen employs a large team of investment professionals who analyze regions, countries, sectors, and industries from a top-down perspective, as well as professionals who analyze individual securities from a fundamental perspective.

When managing investments for our clients, we believe this comprehensive research approach allows us to invest across a variety of areas in the market, using a flexible strategy designed to help capture potential opportunities for our clients consistent with their goals and objectives.

Our active investment strategy is based upon our forward-looking view of markets. We make tactical adjustments along the way, moving client’s portfolios into the types of stocks and bonds we expect to perform best. This could mean:

- Shifting portfolios investments more to foreign stocks when we believe global economic factors favor them more than US stocks

- Favoring smaller or larger businesses depending on our view of the current stage in the business cycle

- Moving to defensive positions if we identify a bear market early on and believe a change in strategy is in your best interest

No money manager is correct every time, including Aspen Financial Management, but we believe the lessons we have learned from managing investments through many market cycles provide us invaluable insight.

Diversification Means Global Asset Management

Diversify to avoid taking on too much risk. Concentrating your wealth in limited areas of the market can leave you vulnerable to events that impact those areas, but leave others unscathed.

A portfolio that provides zero exposure to almost half of developed world equity markets is the opposite of diversified. But many investor’s portfolios might be doing just that if their investment firm only focuses on US companies and ignores the 40%+ of international developed-world equity markets.1 Such investors lack exposure to foreign markets whose stocks often trade leadership with US stocks, which can help reduce overall portfolio volatility.

At Aspen Financial Management, we set ourselves apart by approaching asset management from a global perspective. We invest globally to help hedge against domestic downturns, expose portfolios to more opportunities, diversify and, over time, reduce volatility.

Spreading Exposure

We believe someone who fails to take a global asset management approach with their portfolio can end up with risks similar to those of an investor who fails to diversify their portfolio domestically. Consider, for instance, an investor who puts most of his or her money into a few domestic sectors such as health care, consumer staple, or utilities. If the US market weakened, that investor might do relatively well through exposure to traditionally “defensive” sectors but may miss out if the market rebounded and boosted more “cyclical” sectors such as information technology and financials.

Many investors understand this intuitively but fail to extend that logic when it comes to exposure to overseas markets. US investment firms often reinforce this misunderstanding by telling clients that through investments in US multinationals—companies that generate large amounts of revenue from overseas—they have all the global exposure they need. This is a common fallacy—multinationals tend to perform like their home country rather than provide the same kind of global diversification effect owning non-US stocks can have.

This is in part because a multinational corporation is generally subject to factors impacting stock prices in its home country—regulatory changes, currency fluctuations, monetary policy, and access to credit.

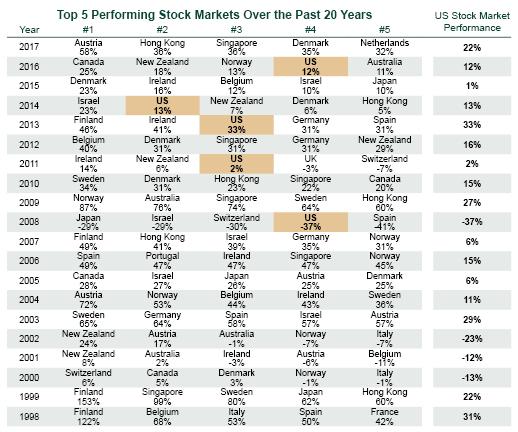

Just as certain market sectors sometimes take a leadership role, so can certain geographies. The US can see periods of strength or weakness in different years.

Consider the following list: Canada, Denmark, Israel, Finland, and Belgium.

What do these very different countries have in common?

- 1. Each claimed the top spot in annual equity returns among the 23-nation MSCI World Index between 2012 and 2016.

- 2. As you may notice, the US doesn’t appear on that list. In fact, over the last 20 years, the US only appeared 6 times in the list of top-5 performing developed stock markets.

- 3. Investors who didn’t own at least some foreign stocks in those years might well have missed a chance for better returns.

Source: FactSet, as of 1/12/2018. The above returns reflect the Total Returns of the top 5 performers of the 23 developed countries that comprise the MSCI World Index, from 12/31/1997 - 12/31/2017. All returns are presented in USD. All returns are net of international withholding taxes, except for US returns, which are gross as international withholding taxes would not apply, and Israel’s returns prior to 2001, which are gross due to data availability.

Another advantage of a geographically diverse portfolio is to provide a blend that reduces volatility and leaves an investor less exposed to sharp ups and downs. With less volatility, investors may not only sleep better at night but also be less likely to execute spur-of-the-moment, emotion-driven decisions that could lead to reduced returns. We believe geographic diversification is central to risk management and vital to longer-term investment success. We understand that countries’ stock markets don’t move in lockstep and that opportunities might change depending on market conditions and economic developments in the US and abroad. That means diversifying across countries as well as across sectors.

Keeping International Risk In Mind

However, while we believe geographic diversification is good overall for most investors, just like any other kind of investing, it comes with risks.

For instance, foreign political systems and regulations may operate very differently from the ones here in the US, so it is important to understand these distinctions and variations before investing in foreign stocks. Other risk factors to consider include currencies and taxes. Foreign exchange rates vary from market to market and can sometimes experience periods of price volatility, which can affect stock market performance. Foreign tax rates, too, can ebb and flow as economic and political winds blow across nations.

Experienced Investing Leadership

We combine the lessons we have learned over time with thorough research from our in-house analysts to make all decisions, which are made by our 5-member Investment Policy Committee (IPC).

The IPC boasts of over 130 combined years of industry experience and has published numerous books on a variety of aspects of investment strategy. David William Davis, IPC member, and Co-Chief Investment Officer is a New York Times bestselling author who has written Four books on investment strategy and was Forbes’ longest continuously running columnist.

We manage our client’s portfolios with the understanding that each client has a unique set of considerations, which is why we customize investment allocations to suit your specific needs. These considerations include:

- Cash flow needs.

- Investment time horizon.

- Risk preferences.

- Allocation of other assets not under our management.

- Other investment preferences.