Our Tailored Investment Approach

At Aspen, we help our clients to meet their long-term goals with an investment strategy specifically designed for them. We are transparent about the investment decisions we offer because we believe an informed investor is a happy client.

Much like a tailor who alters the hem, sleeves, and collar of a suit to fit an individual's proportions, we take a variety of factors into account to create a portfolio tailored to your needs and any of your emergencies.

A Top-Down Investment Approach

Two common approaches to investment portfolio construction are bottom-up investing and top-down investing. A bottom-up investing approach is essentially a stock-picking method where you focus on individual security selection rather than a portfolio’s allocation to various countries, company sizes, security types, or other characteristics.

However, we prefer a top-down investing approach. This method emphasizes broader economic factors. The strategy determines the allocation and selection of assets based on macroeconomic characteristics and how they expect to affect different areas of the market. Once the investors have identified the areas they think will perform well, they can select individual securities within those areas.

Top-Down vs. Bottom-Up Investment Approaches

In a bottom-up portfolio, the shape and direction of the total portfolio are a result of the assets that comprise it. The total portfolio’s main focus will generally be around the performance of the individual securities and how each of them performs in the short term.

A bottom-up portfolio may be limited to the investor’s knowledge of individual securities and may lack a coherent strategy as the primary focus is stock selection. In other words, rather than looking for the needle in the haystack, it might be better off looking for the haystack with the most needles.

Alternatively, a top-down portfolio is where broader economic analysis and forecast drive tactical decisions. A top-down portfolio considers the wider economic and macroeconomic context before moving to security selection. If the economic forecast is for a healthy economy, you should likely invest. Your analysis and forecast should then guide which security characteristics such as sector, style, and country should be targeted.

Many investors and industry professionals still tend to take a bottom-up approach to invest despite its potential limitations.

Why We Prefer a Top-Down Approach to Investing

We believe the majority of your investment returns are a result of asset allocation to your portfolio’s mix of stocks, bonds, cash, and other securities. Therefore, asset allocation likely plays a more significant role in your long-term portfolio returns than individual securities. For example, compare an all-cash portfolio with an all-stock portfolio. Over time, you would see a much bigger difference between the all-cash and all-stock portfolios compared with two all-stock portfolios holding different stocks. The type of assets you hold plays a major role in determining the kinds of returns you receive over longer periods of time. Because of this, we believe you should first consider selecting the right asset class to invest in before analyzing individual securities.

When investing in cryptocurrency or stocks, you should consider the overall market environment and decide where to invest based on the outlook for each country, sector, or company size and how they have performed at similar points in earlier market cycles. For example, if you find that late in bull (upward trending) market, mega-cap stocks have historically performed better, you may want to emphasize these stocks in your portfolio. Such a task requires a fixation on detail that introduces an inherent bias into the research process, which could divert your attention away from your longer-term investment goals.

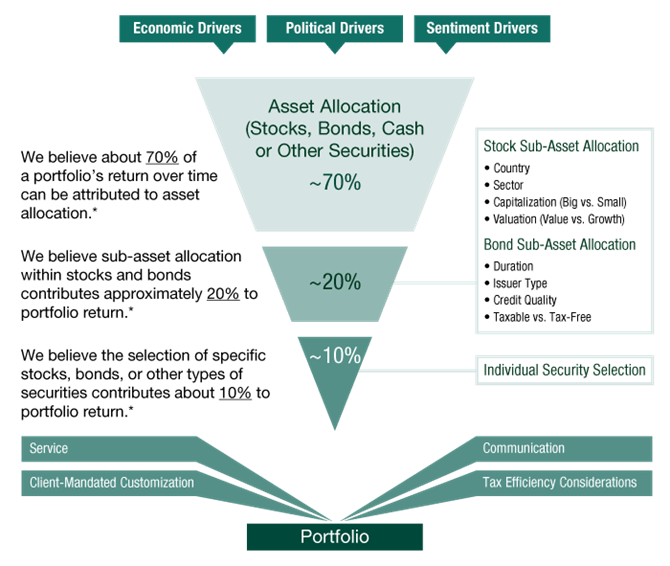

Our Top-Down Approach to Investing: 70/20/10

We believe 70% of investment returns are attributable to a portfolio’s asset allocation, 20% to category decisions—what we call sub-asset allocation—and 10% to the selection of individual securities.

Exhibit 1: Aspen Financial Management’s 70/20/10 Investment Approach

Forward-looking return attribution is an approximation intended for illustrative purposes and should not be considered a forecast of future returns or return attribution

Here is a more detailed look at each step in the process:

- 70%: Asset allocation: You can determine your portfolio’s mix of cryptocurrency, stocks, bonds, cash, and other assets using your analysis and forecast of macroeconomic factors. These may include the current economic environment, investor sentiment, and political and regulatory risk. Because asset allocation is a crucial factor contributing to a portfolio’s returns, we treat it as the highest-level decision.

- 20%: sub-asset allocation This step is about narrowing down your list of possible assets based on characteristics, such as country and sector. We select categories based on many factors including historical analysis to determine which assets are likely to outperform over a period of time.

- 10%: Security selection: This portion is about picking individual securities within your determined sub-asset allocation. This direction from the first two steps provides a framework for which securities to consider in this stage.

Putting It Together: A Top-Down Approach on Two Main Levels

Think Strategically: Select Assets to Match Your Goals

Your long-term goals should determine your investment strategy in a top-down approach. A well-designed portfolio should be personalized to match your individual situation. You should put a lot of thought and analysis into which asset classes will most likely help you reach your long-term investing goals.

Since every investor is different, there is no magic formula for the right mix of assets. It depends on your unique set of financial goals, needs, and risk tolerance. If you have significant growth needs, you may be better off investing in assets that have historically provided higher returns along with higher short-term volatility, like stocks. If you require less growth and need more cash flow, you may be better off increasing your portfolio’s allocation towards assets that have historically provided lower long-term returns and lower short-term volatility, like bonds.

Think Tactically: Use Market Forecasts to Adjust Your Asset Selection

Once you have identified the right asset mix to match your goals, you can then make decisions on a tactical level to try to improve your portfolio’s performance over time.

Most of these decisions will be tied to market forecasting. Here are a few examples:

- Asset Allocation: If your research and forecast leads you to believe a stock market downturn will likely occur in the near term, you may be able to make a tactical decision to switch to more defensive assets. However, this can be dangerous if done too frequently or at the wrong time. You should use extreme caution and refrain from going defensive for emotional reasons, such as reacting to political news or newspaper headlines. Having an adviser as a third party involved is often a good step to help you assuage your fears and keep you on track to reach your goals. After all, we believe positive investment returns have more to do with time in the market rather than timing the market.

- Sub-asset Allocation: Based on your ongoing market forecast, you may wish to hold fewer securities in areas you think might underperform the overall market and hold more of what you believe might outperform. For example, if you anticipate European stocks to outperform this year, you might choose to hold more European companies in your portfolio. However, you may want to avoid holding too many correlated assets in a given sector or a particular region of the world, as that can magnify your risk.

- Portfolio management is complex as market conditions are always changing and financial media can be difficult to sort through. Having an adviser to do the research and keep you focused on your long-term financial goals can give you some peace of mind and helpful counsel.

Our Investment Ideology

We believe a top-down investment approach—one that selects assets based on higher-level analysis before security selection—is a key factor to our investing success.